Promissory Note (Interest-Bearing) 1996-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

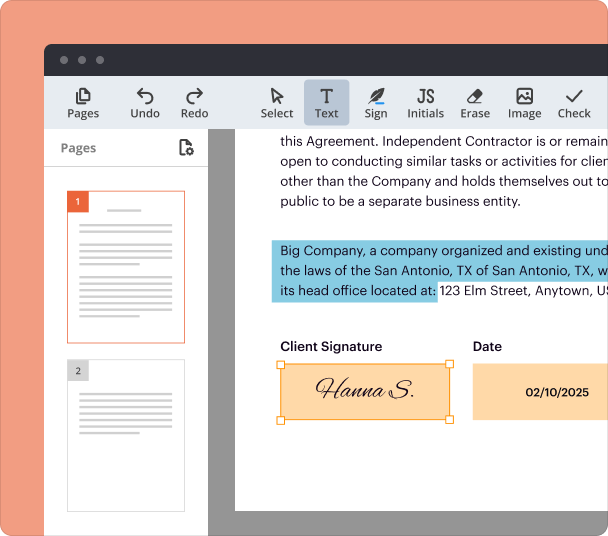

Edit and sign in one place

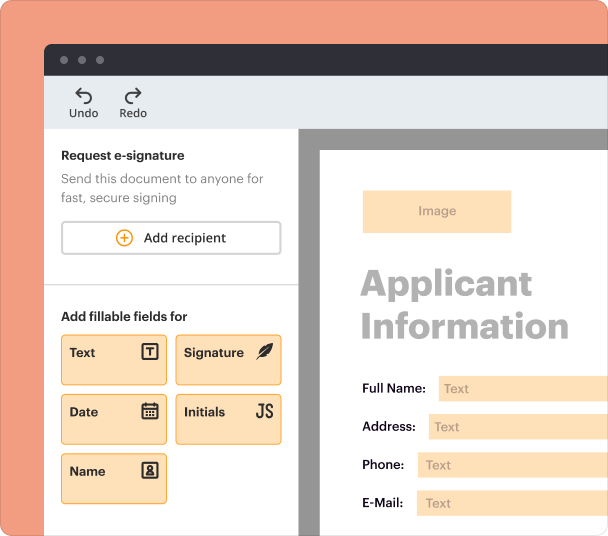

Create professional forms

Simplify data collection

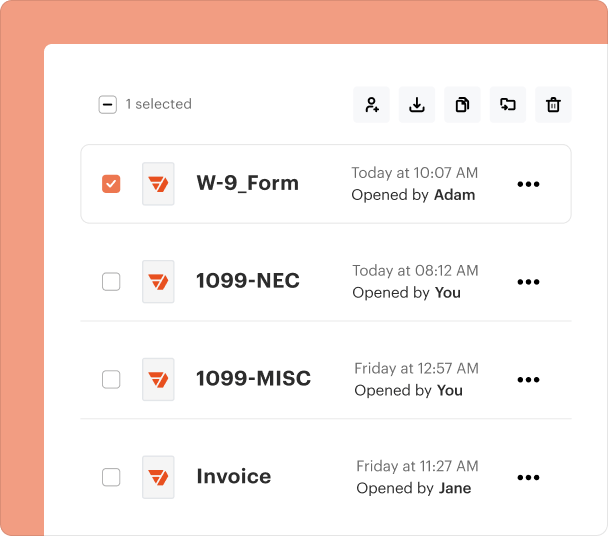

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

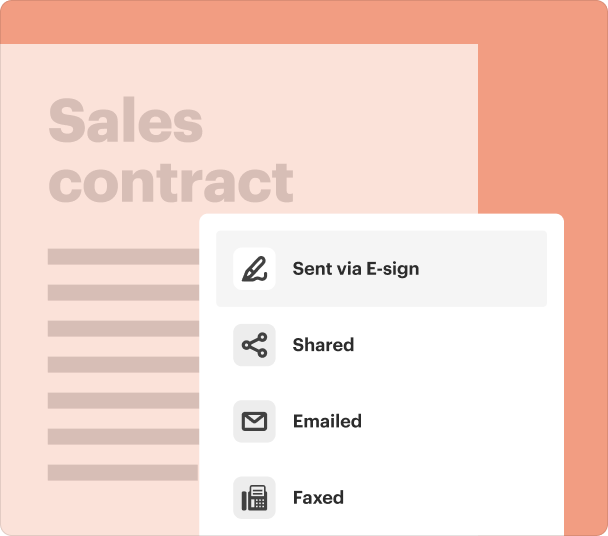

End-to-end document management

Accessible from anywhere

Secure and compliant

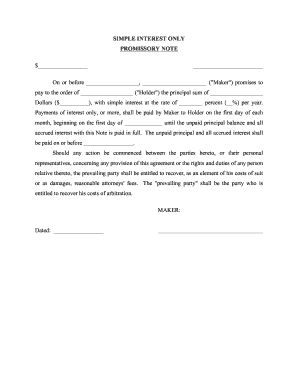

Comprehensive Guide to the Interest-Bearing Promissory Note Form

Understanding the Interest-Bearing Promissory Note

The promissory note interest-bearing form is a legal document that outlines a borrower's promise to repay a specified amount with interest by a set date. It serves as a written agreement often used in financial transactions, especially in lending situations between individuals or entities. This form is vital for ensuring both parties are clear on the terms, including the interest rate and repayment schedule.

Key Features of the Promissory Note

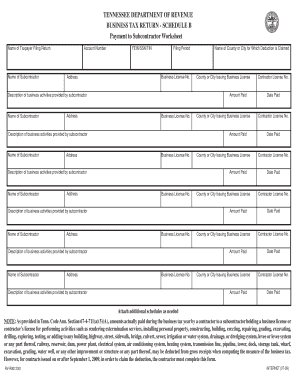

The form includes essential elements such as the principal amount, the interest rate, and the payment schedule. Additionally, it specifies the party to whom the payment is owed and provides space for signatures. Other key features might include clauses regarding late payment penalties and any collateral put up for the loan.

When to Utilize the Promissory Note

Individuals or businesses should consider using the interest-bearing promissory note for personal loans, business financing, or family loans. It is particularly useful when the loan involves interest, as it formalizes the arrangement and provides legal protection for both the lender and the borrower.

Required Information for Completion

To fill out the form accurately, users need to gather specific information, including the loan amount, interest percentage, payment due dates, and the names and addresses of both the borrower and lender. It is also essential to know whether the loan includes any secured collateral, which should be documented.

Best Practices for Filling the Form

When completing the promissory note, clarity is crucial. Users should print clearly and double-check all figures to ensure accuracy, especially the interest rate and payment terms. It may be helpful to review the completed document with a legal professional to clarify any terms or provisions before final signatures.

Security and Compliance Considerations

Since promissory notes are legally binding, it is vital to maintain their security and ensure compliance with local laws. Storing the document in a secure location and making thorough records of payments and communications regarding the agreement can help protect the interests of both parties involved.

Frequently Asked Questions about promissory note format india pdffiller com

What is the purpose of an interest-bearing promissory note?

The purpose of an interest-bearing promissory note is to formalize a loan agreement between a borrower and lender, detailing the amount borrowed, interest rate, and repayment terms to ensure clarity and legal protection.

Can I customize the terms of the promissory note?

Yes, users can customize terms within the promissory note, including the interest rate, repayment schedule, and any penalties for late payment, as long as all parties agree without violating any laws.

pdfFiller scores top ratings on review platforms